Can AI Perform an R&D Tax Credit Study?

- Artificial Intelligence, R&D Credit

Recently, major questions have been asked about pop-up shops claiming to do taxes with artificial intelligence (AI). Some are even saying they can perform studies for complex incentives such as the Research and Development (R&D) credit. The Internal Revenue Service (IRS) has this to say flatly: “…taxpayers should not rely on AI-generated responses to complex tax questions.”

There are some great uses for AI, specifically for handling repetitive tasks that have predictable outcomes. But tax work, especially complex credit studies, has always required extensive experience and human judgment due to the complexity and variability inherent in the tax code – nothing about the new AI trend changes that.

IRS’s Warning Against Reliance on AI for Tax Matters

The IRS has criticized the widespread use of AI to solve complex tax problems. As of now, no IRS-approved AI methodologies exist for tax work.

Erin Collins, the National Taxpayer Advocate at the IRS Taxpayer Advocate Service, has been at the forefront of critiquing the blind faith placed in AI-generated solutions. Her guidance cuts to the core: “None of us should completely rely on AI.” This message accompanies the National Taxpayer Advocate warning in a recent article, cautioning taxpayers against putting trust in AI-generated tax advice due to the fact that “AI assistants may encounter difficulties interpreting complex tax laws correctly or considering unique circumstances that could impact a taxpayer’s return.”

To illustrate the point further, the taxpayer advocate cited a concerning revelation from a Washington Post investigation, which showed that a staggering 50% of responses furnished by two leading tax providers’ AI chatbots to intricate tax queries were “inaccurate or irrelevant”. This statistic not only bolsters the IRS’s skeptical stance but also showcases the inherent dangers of substituting human expertise with AI.

As a final point, the IRS stated, “Taxpayers are ultimately responsible for the information reported on their tax returns.”

The Human Element: Irreplaceable Judgment and Interpretation

Like the ERC pop-ups before them, fly-by-night R&D providers are claiming to have a shortcut to complex incentive calculations – in this case by overselling AI’s capabilities, claiming it outperforms traditional methods by enhancing efficiency and streamlining processes. This portrayal dangerously simplifies a complex reality: AI can only make determinations with the data provided to it. Seldom do business owners have all of the necessary information in a form digestible by an AI to make legal and tax determinations.

That’s why R&D studies almost always require employee interviews, statistical sampling of projects, time tracking, and on-site visits to properly substantiate a credit. The underlying data for these study steps is never in one unified or consistent format and requires human judgment to even just get it organized so someone can look at it and find where the holes are, making it impossible for an AI to predict or calculate a credit.

Furthermore, even if all the underlying data were to be available in a consistent format, AI will struggle with complex tax laws or consider unique circumstances, and the pop-up provider’s solution is to have the taxpayer make the legal and tax determinations. To put it another way, the AI will ask you to serve as your own attorney/legal expert, and to attest to the correctness of your determination.

Figuring out qualifications for these credits isn’t just about sorting through data – it requires understanding complicated rules that AI cannot grasp without a human’s help. It needs expertise and intuition in situations where AI doesn’t have enough data, can’t understand the data it has, needs to draw conclusions from the data, or requires making determinative judgments in the gray areas (which are abundant in complex tax credits). This all points to how much we still depend on people, not AI, for the really important decisions.

“At some point, you have to pay the piper” rings particularly true in this context—it’s about the inevitable confrontation with the consequences of cutting corners that will come to light during an audit by the IRS.

Inefficient AI Models in Tax Practice

To qualify for the R&D credit, a business must have engaged in qualifying activities subject to the four-part test:

- New or improved business component developed for a permitted purpose

- Process of experimentation

- Elimination of uncertainty

- Technological in nature

While AI can sort through the data, an AI would not be able to draw any conclusion relating to the four-part test from the data provided. Generally, even if a business qualifies, the only data they will have pertaining to the R&D credit is a project list that needs to be extensively vetted.

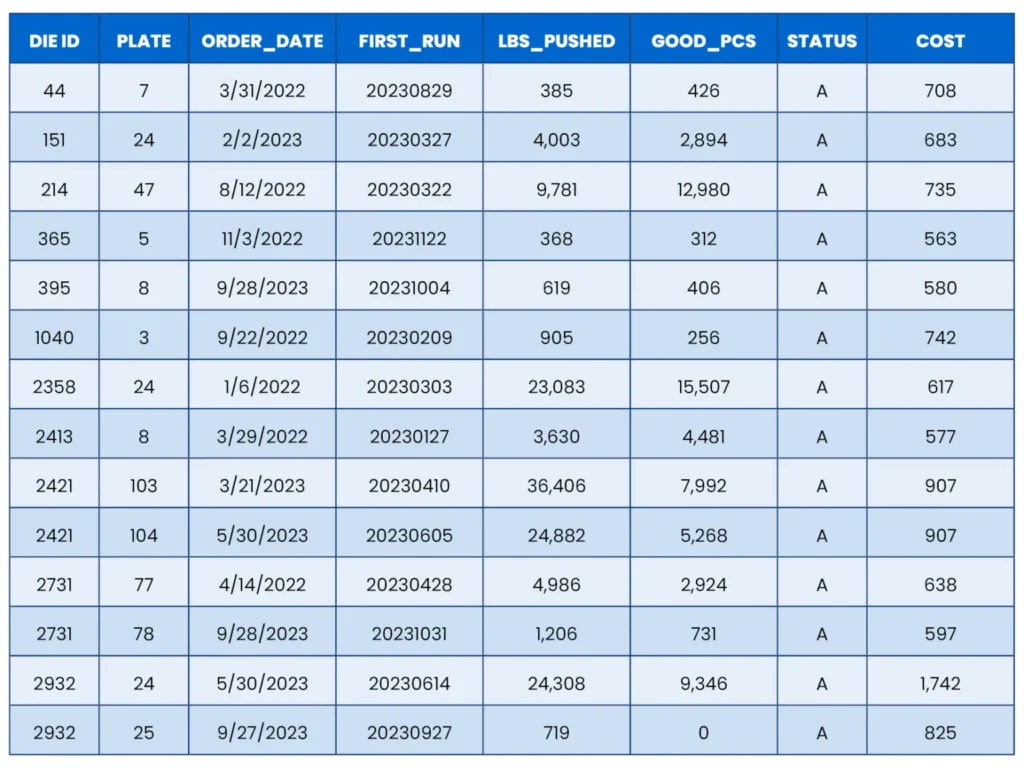

Figure 1

Take a look at the dataset in Figure 1. This is a typical dataset that only outlines costs and quantities associated with various parts, but it lacks detailed insights into the specific activities undertaken to create or improve these components.

Often, such data is the only thing a business can provide, and an AI will not be able to determine which of these projects underwent a process of experimentation, whether the projects were technological in nature, what uncertainty was being eliminated, or whether the project was for a permitted purpose. Note that all of these must be documented when claiming the R&D Credit. Without human interviews and onsite visits, this data will not be found anywhere in a business’s systems.

Even sophisticated businesses will, at most, supply time-tracking data to go along with their project lists. Still, this data does not speak to the four-part test, and it does not account for critical exceptions and unique circumstances.

Without explicit data detailing R&D activities, AI analysis might not recognize the presence of technological uncertainties or the experimental nature of the work. In contrast, an experienced R&D tax credit provider can determine this information through more hands-on activities and by asking the right questions.

Conclusion

As Darren Guillot, alliantgroup National Director and Former IRS Commissioner, SBSE, so aptly put forth, taxpayers and their advisors bear the ultimate responsibility for the accuracy of their filings. “CPAs know that you can’t rely on software as an excuse. If there’s an error on a tax return and one of your clients gets audited, you can’t reply and say, ‘Oh, it’s AI’s fault.’ It’ll sound like the dog ate my homework.”

This analogy highlights the professional responsibility in financial reporting and tax liability. The significance of due diligence and professional judgment cannot be overstated in tax preparation and financial responsibility, as there may be dire consequences.

It is crucial for CPAs to recognize the mantle of responsibility they carry in guiding their clients through the complexities of tax preparation and financial planning. It goes beyond compliance. They need to educate their clients on the impact of relying on AI for an R&D tax credit study.

While AI offers promising tools for enhancing the efficiency and scope of R&D Tax Credit studies, the notion of it completely replacing human judgment and expertise is far-fetched under the current technological landscape. The combination of judgment, interpretation, and strategic thinking that human experts contribute to these studies is unparalleled.

alliantgroup has been in the credits and incentives industry for a quarter of a century. We also have an AI practice where we’re consulting businesses on using AI in the right way. We use AI to improve the client experience and the quality of the R&D study, without replacing human judgment with AI during critical legal and technical evaluations.

If you would like to speak to an industry expert and conduct your R&D study the right way, set up an appointment today!